No budget relief as ministries brace for more spending cuts

By Maureen Kinyanjui |

The government is projecting to raise Sh3.4 trillion in revenue for the next financial year.

Government ministries and other state agencies are bracing for tighter budgets after the National Treasury confirmed that there will be no relief in the upcoming financial cycle.

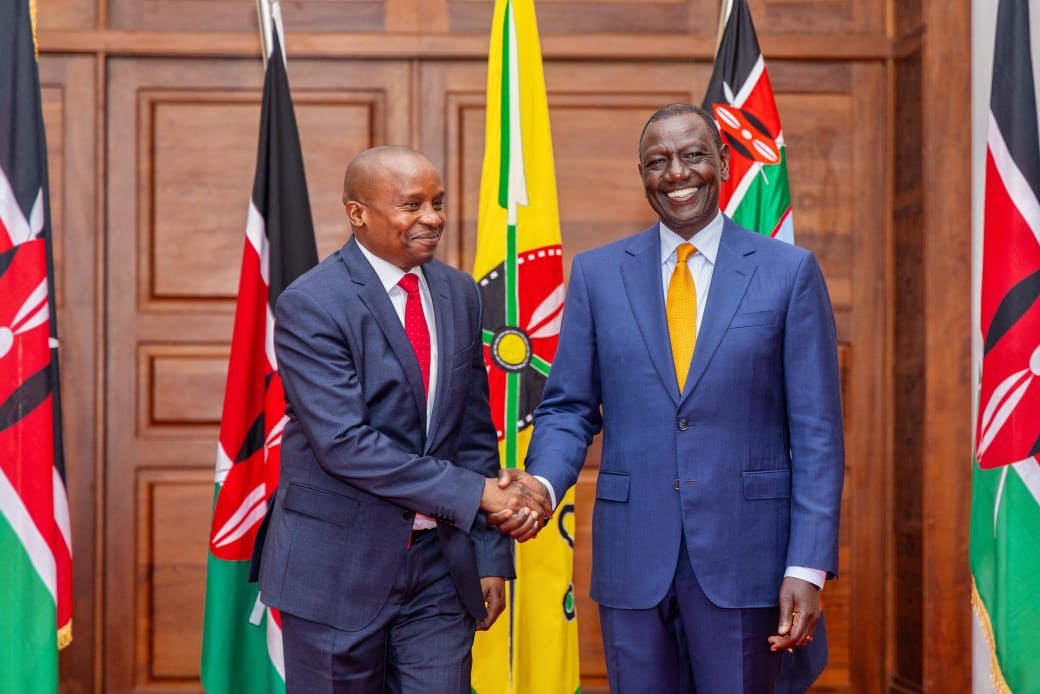

Treasury Cabinet Secretary John Mbadi has revealed that President William Ruto's administration plans to extend austerity measures into the next fiscal year, aiming to manage the government's financial challenges.

Keep reading

Ministries and state agencies have been instructed to review their current and future activities, projects, and programmes that are expected to be funded in the 2025-26 budget.

These instructions come as part of the 2024 Budget Review and Outlook Paper (BROP), which outlines the new measures.

"Sector Working Groups (SWGs) are required to eliminate wasteful expenditures and pursue priorities aimed at safeguarding livelihoods, creating jobs, reviving businesses, and promoting economic recovery," Mbadi explained.

Revenue and spending projections

The government is projecting to raise Sh3.4 trillion in revenue for the next financial year, with Sh3 trillion expected from domestic sources.

However, expenditure is expected to reach Sh4.16 trillion, out of which Sh3.06 trillion will be allocated to recurrent expenses, while Sh663.2 billion will go toward development projects.

County governments are slated to receive Sh432.7 billion from the national budget, while Sh5 billion will be set aside for the contingency fund.

According to Treasury, the budget estimates have been revised from earlier projections.

"The medium-term fiscal projections in the 2024 BROP have been revised from those of the 2024 Budget Policy Statement estimates, taking into account the fiscal outcome of FY 2023-24 and the impact of the withdrawal of the Finance Bill, 2024," the document reads.

The collapse of the Finance Bill, 2024 has resulted in a revenue shortfall of Sh283 billion, further increasing the budget deficit to Sh768 billion.

This gap is expected to persist into the next fiscal year.

Tougher measures ahead

In response to the cash crunch, the Treasury has introduced strict measures to ensure financial discipline across all ministries, departments, and agencies. Mbadi has directed these entities to justify all planned expenses for the coming fiscal year.

"SWGs should ensure emphasis is placed on allocating the limited resources based on programme efficiency and requirement, rather than incremental budgeting," Mbadi said.

The government will continue to use the zero-based budgeting approach in the fiscal year 2025-26 and beyond, as part of efforts to manage expenditure effectively.

The Treasury has acknowledged that the government is still facing significant financial strain, particularly due to revenue shortages, rising public debt, debt servicing costs, expenditure carryovers, and pending bills.

"In view of this, the government will continue to pursue a fiscal consolidation policy with the overall aim of reducing fiscal deficit and debt accumulation," Mbadi stated.

The focus will be on increasing revenue while prioritising essential government programmes and social spending. The Treasury plans to enhance revenue collection by implementing both tax administration and tax policy reforms.

The government aims to improve tax compliance by broadening the tax base, reducing tax expenditures, leveraging technology to modernise tax processes, closing revenue loopholes, and increasing the overall efficiency of the tax system.

Non-tax measures will be explored, with ministries, departments, and agencies expected to implement initiatives through the services they provide to the public.

To ensure efficient public spending, the government will continue to enforce austerity measures aimed at cutting non-essential expenditures and improving spending efficiency.

"This will include the implementation of austerity measures aimed at reducing recurrent expenditure," Mbadi added.

Reader comments

Follow Us and Stay Connected!

We'd love for you to join our community and stay updated with our latest stories and updates. Follow us on our social media channels and be part of the conversation!

Let's stay connected and keep the dialogue going!